The barball strategy, popularized by Nassim Taleb, is a way to navigate risk/reward tradeoffs when you’re skeptical about the accuracy the risk estimates. While it originated in financial investing, it can apply to product and business strategy.

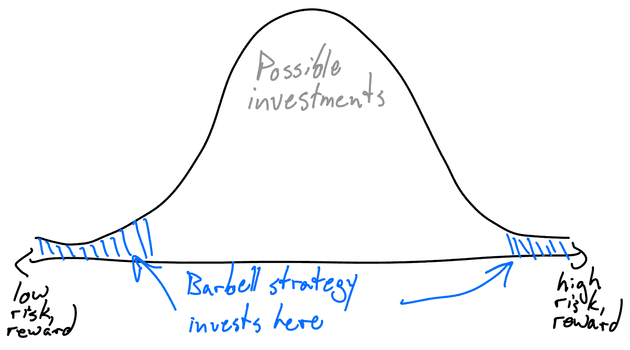

Imagine a menu of investments ranging from low-risk & low-reward to high-risk & high reward. The barbell strategy picks mostly conservative low risk investments to cap losses, and a few high risk bets in the hopes of outsized payoffs. It ignores middle-of-the-road investments.

The key insight is that risk estimates have systemic bias to understate the risk. For example, projects are far more likely to be late and over-budget than early and under-budget.

Thus, middle-of-the-road investments are generally riskier than managers think. The barbell strategy is resilient to poor risk estimates.

I’ve found this model implicit in John Doerr’s approach to product strategy when he advocates for a blend of mostly “roofshot” product investments, and a few “moonshot” product investments.

It can also apply to business strategy of when to defend existing markets versus expand into new markets.